The Corporate Transparency Act (CTA) is poised to have a significant impact on online businesses across America. While aimed at combating financial crimes, this legislation’s reach extends far beyond its intended targets. Let’s explore the Corporate Transparency Act impact on online businesses and what it means for entrepreneurs.

Understanding the Corporate Transparency Act Impact on Online Businesses

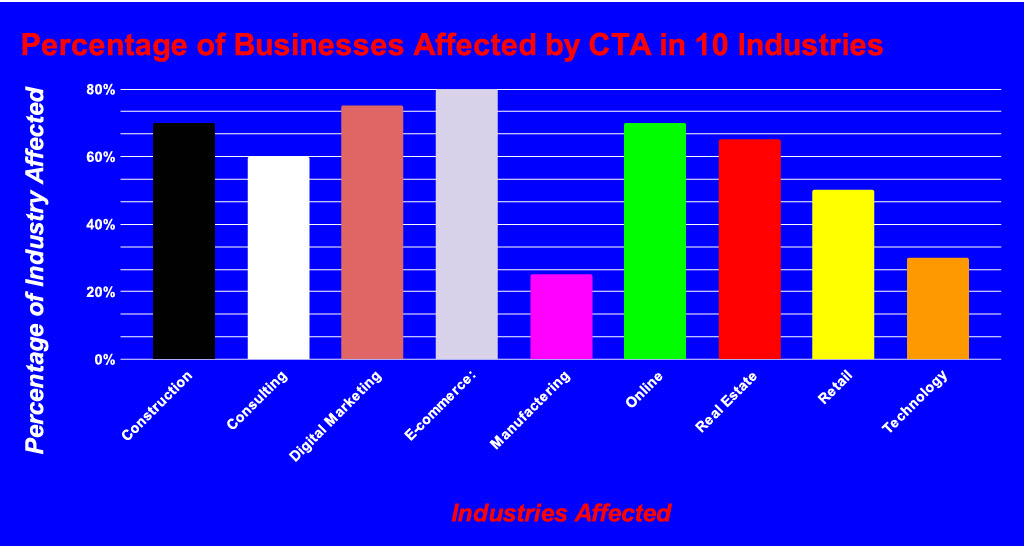

The CTA’s effects on small businesses are more far-reaching than many realize:

- Home-Based Entrepreneurs: Even if you’re operating from your living room, you may be subject to new reporting requirements.

- High-Revenue, Low-Headcount Operations: Your sales volume, not employee count, could trigger compliance needs.

Real-World Examples of Corporate Transparency Act Impact on Online Businesses

The Podcaster Scenario

Imagine you’re a podcaster with a successful show:

- You’re incorporated and working from home

- Your show generates $8 million in annual revenue

- You have only one or two employees

Despite being over $5M in sales, which is one of the fundamental requirements for not having to comply. You still have to comply and do all the paperwork because you have no physical location and you do not have over 20 employees.

Real Estate Developers Face Unique Challenges

The Corporate Transparency Act small business impact extends to real estate:

- Multiple LLCs for different properties may each require separate reporting

- High-value transactions with low employee counts don’t provide exemptions

Compliance Requirements for the CTA

Affected businesses must file a Beneficial Ownership Information (BOI) report with FinCEN, including:

- Detailed company information

- Personal data on beneficial owners

This represents both a privacy concern and an administrative burden for small businesses.

Navigating the Corporate Transparency Act

- Assess Your Exposure: Determine if your business falls under the CTA’s purview

- Consult Legal Counsel: Understand your obligations and explore potential exemptions

- Prepare for Compliance: If affected, start gathering necessary information now

- Stay Informed: Keep abreast of any legislative changes or legal challenges to the CTA

The Bottom Line on CTA Impact on Online Businesses

The CTA’s impact on small businesses is a prime example of legislation creating unintended consequences for America’s entrepreneurs. As business owners, it’s crucial to understand these new requirements, comply where necessary, and stay informed about how this act may affect your operations.

By staying prepared and informed about the Corporate Transparency Act small business impact, by becoming a SWORD member. This membership is designed to empower entrepreneurs to navigate these new regulatory waters while continuing to drive innovation and economic growth. Let us do all the research. All you have to do is subscribe and all our premium content is yours on demand.