The Corporate Transparency Act (CTA), which went into effect on January 1, 2024, requires small businesses to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. This new regulation has sparked concerns among small business owners, who see how this act could lead to the destruction of small business freedom, which is a pillar of a free country.

Owning your own business is the ultimate form of freedom. You are free to provide for yourself and family without worrying about anyone else’s interest or motives being placed above your own. Owning your business puts all the power over your life in your hands.

In this article, we’ll explore how the CTA’s requirements are similar to the petty regulations used by communist and fascist regimes to control and stifle small businesses.

Governments which have taken away people’s freedoms start with taking away the ability for individuals to start their own business or they make it almost impossible.

How the Soviet Union Destroyed Small Business Freedom

In the Soviet Union, the government controlled every aspect of the economy, dictating what businesses could and couldn’t do, and allocating resources accordingly. This approach led to a lack of competition, innovation, and productivity, ultimately resulting in the downfall of the Soviet economy. Similarly, the CTA’s requirements for small businesses to report beneficial ownership information may be seen as an overreach of government control, stifling the growth and innovation of small businesses.

The Impact of Overregulation on Small Business Freedom

Overregulation has been a hallmark of communist and fascist regimes, and its impact on small businesses has been devastating. In communist systems, businesses are subject to strict limitations on what they can and cannot do, which can hamper productivity and innovation. The CTA’s requirements for small businesses to report beneficial ownership information may be seen as a similar attempt to control and stifle small businesses.

The CTA’s Requirements

The CTA requires small businesses to report beneficial ownership information to FinCEN, including the names, dates of birth, and addresses of beneficial owners. This information must be reported within 90 days of the company’s creation or registration, and any updates or corrections must be submitted within 30 days. Failure to comply may result in fines of up to $10,000 and imprisonment for up to two years.

The Burden on Small Businesses

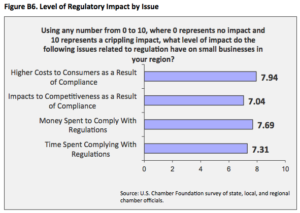

The CTA’s requirements may be seen as a burden on small businesses, which often lack the resources to navigate the intricacies of the law. According to the National Small Business Association, the CTA’s requirements may impose a substantial financial burden on small businesses, with estimated compliance costs exceeding $5.6 billion annually.

The Road to Communism is Paved with Good Intentions

While the CTA’s intentions may be to combat money laundering and other financial crimes, its requirements may have unintended consequences for small businesses, stifling entrepreneurship and innovation. As a conservative small business owner, it’s essential to recognize the dangers of overregulation and advocate for limited government intervention.

If you want to join a network of conservatives business owners who are fighting back against government overreach to ensure our freedom to do business and rule our own lives, join SWORD today.