Vice President Kamala Harris has been positioning herself as the small business candidate, a strategic move considering there are over 33 million small businesses in the United States. However, a closer look at her policies and proposals reveals a different story. Between the Biden-Harris administration’s policies and her campaign proposals, it’s clear that Harris may actually be the anti-small business candidate.

The Regulatory Burden

The Biden-Harris administration has increased the regulatory burden on small businesses by an estimated $1.7 trillion, resulting in over 300 million hours of compliance time. This has led to a decline in small business optimism, with the National Federation of Independent Business (NFIB) survey index staying below its 50-year historic average for 33 consecutive months.

Independent Work and Contractors

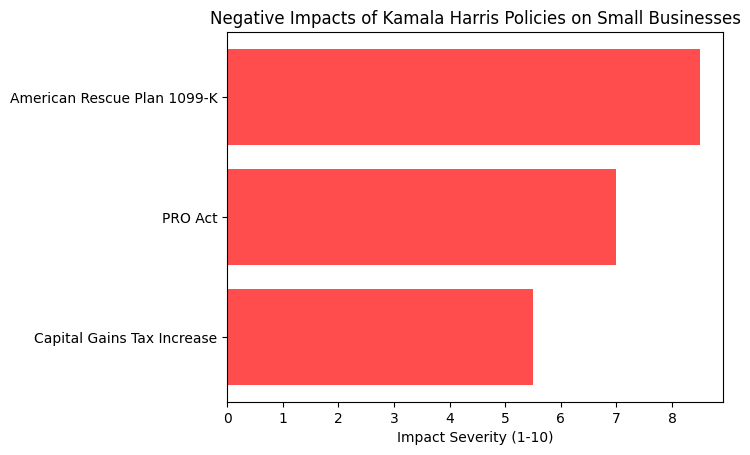

Harris’s stance on independent work is another blow to small businesses. The Biden-Harris administration overturned a Trump-era independent contractor rule in 2021 and implemented restrictive standards for contractor work in 2024. Harris also supports the PRO Act, which includes anti-independent contractor language from California’s AB 5 rule, aiming to take away work flexibility on a national level.

Tax Proposals

While Harris has proposed increasing the tax deduction for start-up costs from $5,000 to $50,000, this plan has been met with skepticism. The National Small Business Association has expressed concern over the period businesses would have to take advantage of the provision, and the impact on existing small businesses is unclear. Additionally, Harris’s plan to raise income taxes, capital gains taxes, and impose a tax on unrealized capital gains would be disastrous for small businesses.

Existing Small Businesses Left Behind

Harris’s focus on startups has been criticized for ignoring the needs of existing small businesses. The Biden administration has reported that approximately 19 million new startups have emerged since 2021, but it’s the over 6 million established, employer-owned firms that are struggling. These businesses face historically low levels of optimism, and Harris’s proposals do little to address their concerns.

Kamala Anti-Business Legislation and Policies

Harris has consistently supported legislation that hurts small businesses. She voted to pass the American Rescue Plan Act, which lowered the Form 1099-K reporting threshold for taxpayers, adding “needless paperwork” for small businesses. She has also proposed increasing the total capital gains rate on individuals making more than $1 million, which would disproportionately affect small businesses.

Don’t Be Fooled by What Kamala Harris Says Look at Her Record

While Harris claims to be pro-small business, her policies and proposals tell a different story. The regulatory burden, restrictions on independent work, and tax proposals all point to a candidate who may be more of a hindrance to small businesses than a help. As the election approaches, it’s essential to consider the impact of Harris’s policies on the backbone of the American economy: small businesses.

If you want to fight back against these anti-business policies and hold our government accountable join SWORD today. We exist to make the voices of small business owners heard.

Further Study into Kamala Harris Stance On Small Business:

1. https://www.foxnews.com/opinion/kamala-harris-claims-supports-small-business-doesnt-have-receipts

2. https://www.taxnotes.com/featured-news/harris-courts-small-businesses-new-tax-proposals/2024/09/04/7l5ss

3. https://www.theguardian.com/business/article/2024/sep/08/kamala-harris-small-businesses

4. https://amac.us/newsline/society/kamala-harris-would-be-a-disaster-for-small-businesses/

5. https://waysandmeans.house.gov/2024/09/09/fact-check-harris-threatens-new-tax-hikes-for-small-business/

6. https://www.forbes.com/sites/rhettbuttle/2024/09/06/kamala-harris-focus-on-small-business-her-job-creation-plan/