Breaking News: Corporate Transparency Act Deemed Unconstitutional

On March 1, 2024, a federal judge in Alabama made a groundbreaking decision, ruling the Corporate Transparency Act unconstitutional. This ruling has sent shockwaves through the business community and legal circles alike.

Key Reasons Behind the CTA Unconstitutional Ruling

The court’s decision to declare the Corporate Transparency Act unconstitutional was based on several crucial factors:

- Exceeds Congressional Authority: The judge determined that the CTA goes beyond the constitutional limits of Congress’s legislative power.

- Not Justified by Foreign Affairs Powers: The court ruled that the CTA is not authorized by Congress’s foreign affairs powers, as incorporation is typically governed by state law.

- Commerce Clause Doesn’t Apply: The judge found that the CTA doesn’t regulate commercial activity or substantially affect interstate commerce.

- Insufficient Link to Taxing Authority: While recognizing some relationship between the taxing power and the CTA’s requirements, the court deemed it not “sufficiently close” to justify the act.

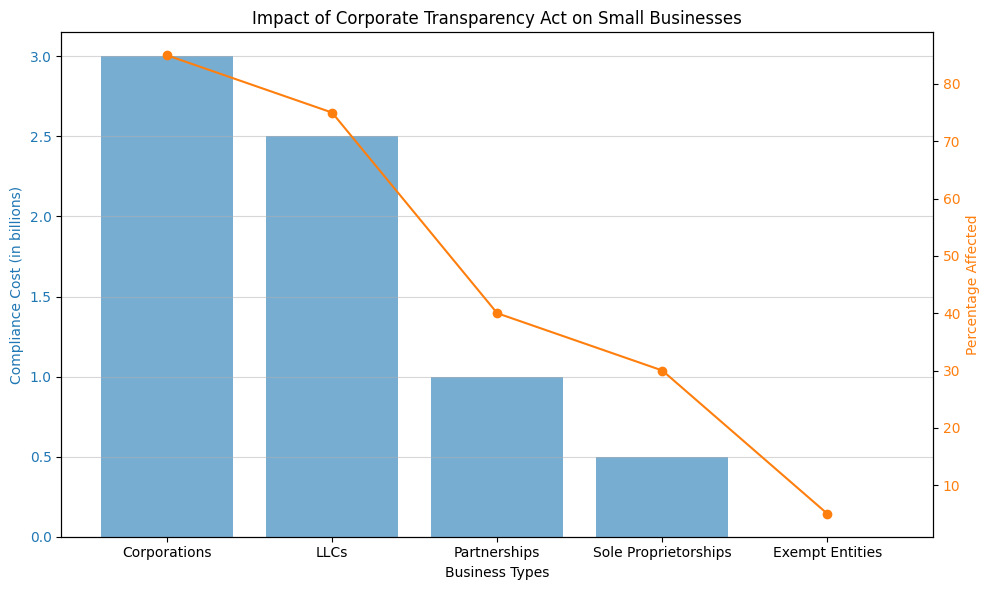

Implications of the CTA Unconstitutional Ruling

While the Corporate Transparency Act unconstitutional ruling is significant, it’s important to note that its immediate impact is limited:

- The ruling currently applies only to the plaintiffs – the National Small Business Association and its members.

- Other businesses are still required to comply with the CTA and file beneficial ownership reports as per FinCEN regulations.

What’s Next for the Corporate Transparency Act?

The Justice Department has filed a Notice of Appeal in the Eleventh Circuit on behalf of the Treasury Department and FinCEN. This means the debate over whether the Corporate Transparency Act is unconstitutional is far from over.

Key Takeaways for Small Business Owners

- Stay informed about developments regarding the Corporate Transparency Act unconstitutional ruling by becoming a member of SWORD.

- Continue preparing for CTA compliance unless directly affected by the current ruling.

- Consult with legal professionals to understand how this might impact your business.

As the legal battle over the Corporate Transparency Act continues, small business owners must stay vigilant and prepared. While the act has been ruled unconstitutional in this case, its future remains uncertain. Keep an eye on further developments and ensure your business is ready to adapt to any changes in the regulatory landscape.